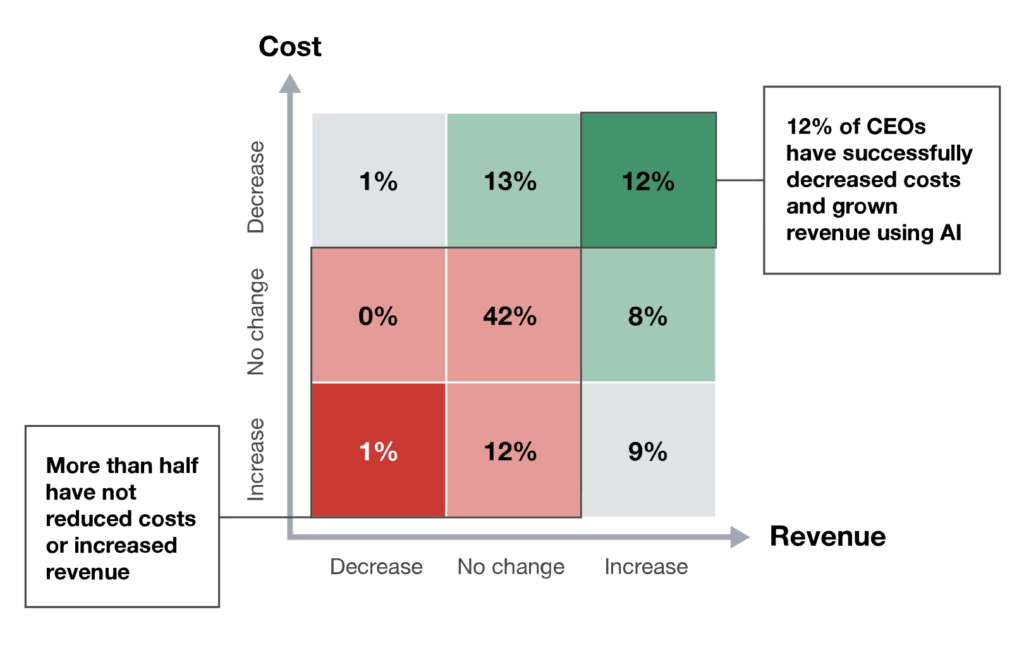

- 56% of CEOs say their organizations have not yet seen meaningful cost or revenue benefits from AI

- Only 12% report gains in both cost reduction and revenue growth from AI

- 42% of CEOs report competing in sectors outside their core business

- Revenue confidence is at a 5-year low, with only 30% very confident about near-term growth

In 2026, the narrative around artificial intelligence has shifted dramatically. What was once a symbol of competitive advantage is now a defining divide between leaders and laggards, not because the technology isn’t powerful, but because many organizations have neglected foundational work needed to turn AI into value. PwC’s 29th Global CEO Survey finds that more than half of CEOs report no measurable financial gains from their AI investments, pointing to execution gaps, missing data foundations, and a lack of enterprise‑wide integration as key barriers.

As a result, tech and business leaders are now reframing how they think about AI and transformation, moving beyond hype and experimentation toward strategic, outcome‑oriented deployment.

AI’s Value Gap Is the New Strategic Fault Line

CEOs globally are wrestling with a stark reality: broad AI adoption alone isn’t enough, impact at scale is what matters. Despite nearly universal investment and experimentation with AI, a majority of organizations have yet to see significant financial return.

This outcome isn’t about technology maturity; it’s about integration, governance, and business alignment. CEOs are increasingly asking whether investments are matched with strong data foundations, responsible AI frameworks, and leadership commitment, rather than isolated pilot projects.

At the same time, PwC report highlights that nearly half of CEOs have shifted their competitive focus outside traditional industry boundaries, signaling that strategic reinvention is now a core growth lever.

Widespread Adoption, Patchy Integration

AI is permeating strategy discussions and tactical deployments across organizations but deep integration remains rare.

- A small minority of firms have embedded AI extensively across products, services, and decision processes.

- Most still struggle with siloed tech stacks, disconnected workflows, and incomplete governance frameworks that limit enterprise impact.

In practice, this means that insights exist in pockets, but sustained execution across functions is limited, slowing responsiveness and eroding confidence in AI’s strategic value.

Strategic Ambition Meets Execution Reality

Another clear signal from the survey is the shift in how CEOs are allocating focus and capital: revenue uncertainty is rising, and strategic agility is becoming a deciding factor in competitive positioning.

Only about 30% of CEOs feel highly confident in near‑term revenue growth, the lowest level in five years underscoring heightened caution amid macroeconomic and technological change.

In this context, leaders are recalibrating investments toward capabilities that not only enable AI but operationalize it spanning cross‑functional orchestration, platform readiness, and talent alignment.

What this Means for Vendors Across AI, Data, and Digital Transformation

The PwC data signals a reset in how executives evaluate AI investments.

- ROI scrutiny is rising. With over half of CEOs seeing no measurable return, vendors will face tougher questions around business impact, timelines, and accountability.

- AI buying is moving upward. Decisions are increasingly shaped by CEOs and CFOs, not innovation teams, shifting conversations from features to financial outcomes.

- Complexity is now a liability. Organizations are fatigued by fragmented tools and pilots. Platforms that simplify decision-making and reduce stack sprawl will stand out.

- Execution beats experimentation. Buyers want proven use cases tied to revenue, cost, or risk, not future-state roadmaps.

In 2026, relevance will be defined by how clearly AI delivers value.

Also Read: 50% of Companies to Raise Supply Chain Tech Budgets in 2026: APQC