- 50% of organizations plan to increase supply chain technology budgets in 2026

- 93% rank supply chain planning as a top priority, overtaking procurement

- 75% are already using AI for inventory optimization

- Yet only 24% report fully integrated digital and AI systems across functions

For much of the past decade, supply chain transformation was framed around efficiency and cost reduction. In 2026, that framing is no longer enough.

APQC’s latest cross-industry research shows organizations operating in an environment defined by geopolitical instability, trade fragmentation, regulatory pressure, and rising customer expectations, all at once.

While performance improved slightly in 2025, the majority of organizations still failed to meet all business goals. APQC’s report showed only 39% of organizations met or exceeded all business goals in 2025 in terms of supply chain. The result is growing executive pressure to move from reactive execution toward proactive decision-making.

From Execution to Anticipation

One of the most meaningful shifts in the data is where leadership focus is moving.

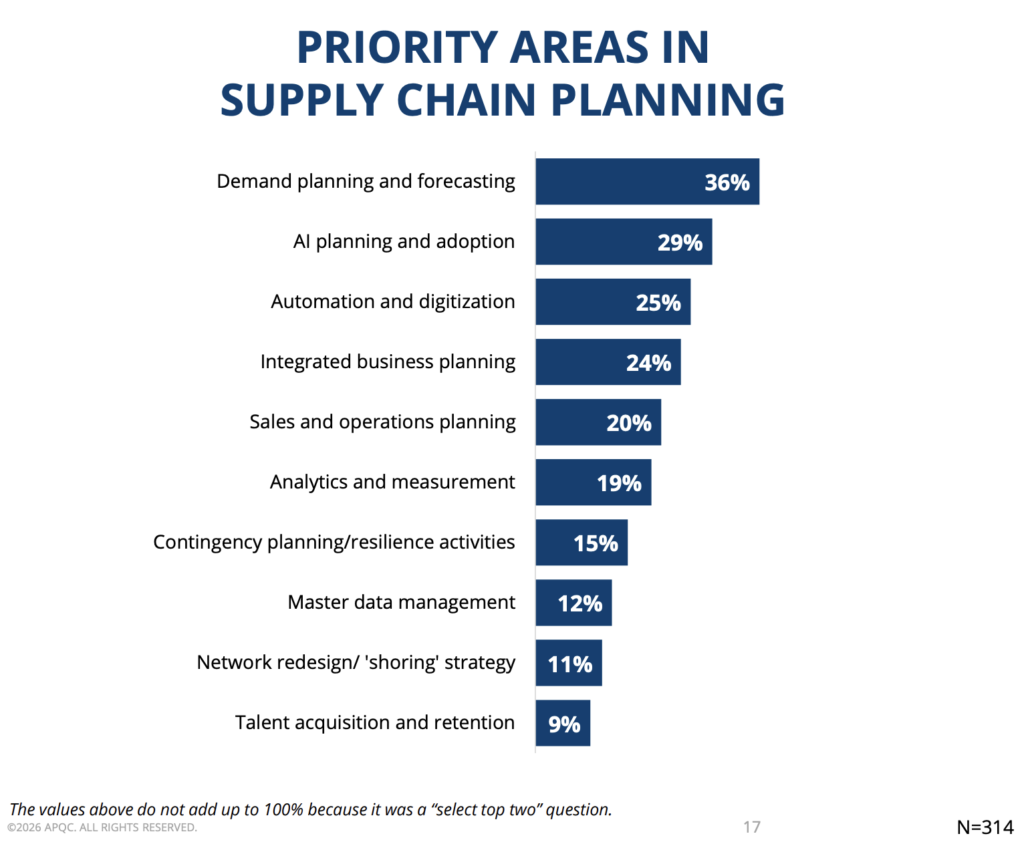

Supply chain planning has become the top organizational priority for 2026, cited by 93% of respondents, a notable shift from prior years when procurement dominated the agenda.

Demand planning, forecasting, AI-enabled planning models, and automation are now central to executive discussions. Leaders increasingly recognize that optimizing logistics or procurement downstream cannot compensate for weak upstream planning.

In volatile environments, the ability to anticipate matters more than the ability to respond quickly. This explains why AI planning and advanced analytics continue to rise in importance, not as experimentation, but as decision infrastructure.

AI is Widespread but Value Depends on Connection

APQC’s data shows that AI adoption across supply chains is no longer theoretical.

Organizations are using AI for inventory optimization, advanced spend analysis, control towers and exception management, scenario planning and network design. However, the report also exposes a critical constraint.

Per APQC report, only about one in four organizations report fully integrated digital and AI systems across functions. Many still operate with partial integration or siloed tools thereby limiting visibility and slowing enterprise-level decisions.

In practice, this means insights exist, but executives cannot always act on them with speed or confidence.The challenge has shifted from whether AI works to whether intelligence flows across the organization.

Supplier Strategy Becomes Executive Strategy

Another strong signal from the research is the elevation of supplier and vendor relationship management. It is now the top priority area within sourcing and procurement, driven by growing concerns around supplier risk, compliance, and lower-tier visibility.

What was once a procurement responsibility is increasingly becoming a governance issue — tied to regulatory exposure, continuity planning, and enterprise risk management. As supply networks regionalize and diversify, visibility into supplier ecosystems is becoming as critical as visibility into internal operations.

The Shift Defining 2026

APQC’s findings point to a broader transformation underway. Supply chains are no longer judged solely on efficiency metrics. They are being evaluated on:

- decision speed

- risk awareness

- planning accuracy

- and cross-functional coordination

For executive teams, supply chain capability has become a competitive differentiator and in many cases, a growth constraint.

What this means for vendors across AI, Data, Procurement, and Supply Chain

For technology providers, the data sends a clear signal. Organizations are ready to invest but only in capabilities that support connected, decision-driven supply chains. This creates opportunity for vendors that can:

- unify data across planning, procurement, and execution

- enable scenario modeling and decision intelligence, not just dashboards

- improve supplier visibility beyond tier-one relationships

- integrate AI into existing workflows rather than add another standalone tool

In 2026, buyers are not looking for more technology. They are looking for clarity in uncertainty, systems that help leaders understand what is happening, what could happen next, and what decision to make before disruption escalates.

Vendors that can align their platforms to that outcome, rather than feature-led transformation, are most likely to resonate with executive buyers in the year ahead.